Prognostications on Federal Tax Legislation in 2021

The results of the 2020 elections are final and official. The 117th Congress is underway and Joe Biden and Kamala Harris will be inaugurated on January 20, 2021. Democrats narrowly control both chambers of Congress and a Democrat will be the next President. What does this mean for federal tax legislation in 2021 and before the 2022 mid-term elections? How many of President-Elect Biden’s tax proposals will be enacted? Will the COVID-19 pandemic hamper these efforts? Will Biden’s other policy proposals take priority? Who knows? Let the prognostications commence...

Lay of the Land for the 117th Congress

In the Senate, after the results of the run-off elections in Georgia became official, the split became 50/50 between Democrats and Republicans. Once Vice President-Elect Kamala Harris is sworn in, Democrats will control the Senate and her vote will be the tie-breaker. From a committee stand-point, Senator Ron Wyden (D-OR) will become the Chair of the Senate Finance Committee after the inauguration. Senator Chuck Grassley (R-IA) will not be the ranking minority member because he is term-limited; thus that role is expected to go to Senator Mike Crapo (R-ID). Finally, 34 of the 100 Senate seats are up for regular election in 2022, 14 of which are held by Democrats, while 20 seats are held by Republicans (two of whom have indicated that they will be retiring at the end of their terms).

In the House, the Democrats have a narrow majority over Republicans of 222 to 211 with 2 seats to-be-filled from districts in Louisiana and New York. The majority may become temporarily smaller as Biden has asked one Democratic Representative to serve in his Administration and he will nominate two others to Cabinet positions, which will lead to vacant seats pending the outcome of special elections. As to the Ways and Means Committee, Richard Neal (D-MA) will continue to be the Chair, while Kevin Brady (R-TX) will continue to be the ranking minority member. Lastly, recent history indicates that Republicans may add some seats during the mid-term elections in 2022 as the President’s party has lost an average of 28 House seats in first-term mid-term elections since Jimmy Carter’s Presidency.

Potential 2021 Tax Legislation

When one party controls both chambers of Congress and the Presidency, major policy changes are often possible. For example, the 2017 Tax Cuts and Jobs Act (“TCJA”) (Pub. Law No. 115-97), which passed with the bare minimum of minority-party support. However, during this same term, Republicans failed to overturn the Affordable Care Act a/k/a Obamacare, even with a larger majority than Democrats currently have. Thus, while significant tax legislation in 2021 is definitely possible, and likely, the small margin of control maintained by Democrats could lead to some difficulties, particularly concerning intra-party agreement on tax legislation.

The primary avenues for 2021 tax legislation will come from: (1) COVID-19 Revitalization/Stimulus measures; (2) Biden’s tax proposals; (3) other Democratic tax proposals; and (4) other policy initiatives with specific tax components, like healthcare, climate change, and green energy initiatives.

On January 14, 2021, Biden released step one of his two-step “American Rescue Plan” COVID-19 relief and stimulus package. Given the two-step nature of the package, a broad sweeping tax bill will likely not gain traction until after the first quarter of 2021, maybe after the second quarter. However, step one of the American Rescue Plan includes the following tax proposals:

- Direct stimulus payments of $1,400 per-person.

- Extending the refundable credit for certain paid leave programs.

- Temporarily expanding and making refundable childcare tax credits.

- Temporarily increasing the Child Tax Credit, making it fully refundable, and making 17-year-olds qualifying children.

- Temporarily enhancing the Earned Income Tax Credit.

- Increasing the health insurance premium tax credit.

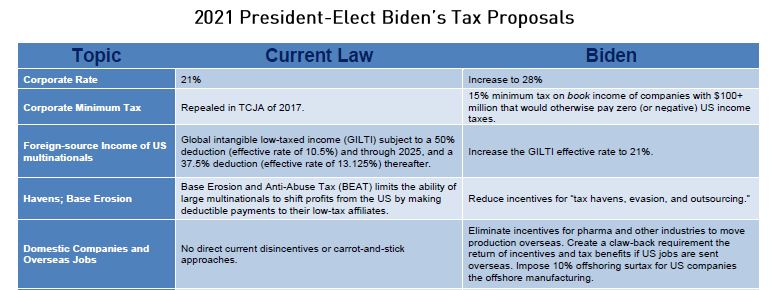

Assuming both parts of the American Rescue Plan are passed in early 2021, we may see Biden start to push Congress to implement some of his tax proposals. Please see the attached table for more details on Biden’s tax proposals, but the primary ones Biden is likely pursue include:

Business

- Raising the corporate tax rate from 21% to 28%.

- Imposing a 15% minimum tax on book income of companies with $100+ million that would otherwise pay zero (or negative) US income taxes.

- Increasing the Global Intangible Low-Taxed Income (“GILTI”) effective rate from 10.5% to 21%.

- Eliminating Social Security tax exemption for wages above $400,000 (exemption for wages between $142,800 and $400,000 would remain), imposed on employers and employees.

- This could create a substantial tax burden for businesses with a significant number of highly compensated employees.

- Reducing the phase-out amount for the 199A deduction on Qualified Business Income to $400,000 and removing the special qualifying rules for real estate.

- Creating an advanceable 10% “Made in America” credit.

- Restoring the Investment Tax Credit for businesses installing solar, geothermal, and wind systems from 22% back to 30%.

Individual

- Raising the highest tax bracket from 37% to 39.6% for filers with income in excess of $400,000.

- Taxing long-term capital gains and dividends at ordinary income rates for filers with taxable income over $1 million.

- Restoring the limitation on itemized deductions if income is over $400,000, and capping the value of itemized deductions at 28%.

- Eliminating Social Security tax exemption for wages above $400,000.

- Increasing the estate tax rate from 40% to 45%, reducing the base exclusion to $3.5 million per taxpayer (currently $11.7 million), indexed for inflation, and repealing the stepped-up basis at death.

- Enhancing retirement tax breaks for low to middle-income workers. Balance the existing forms of retirement saving tax breaks regardless of income.

In order to achieve a consensus with enough Democrats to enable some of his tax proposals to become law, Biden may have to cater to the tax policy desires of other Democrats, like:

- Elimination of the SALT Deduction Cap – soon-to-be Senate Majority Leader Chuck Schumer (D-NY) has already indicated that abolishing the $10,000 SALT deduction cap will be among his top legislative priorities. Other Senators and Representatives from high-income states are likely to assist in this effort.

- Improvement of Retirement Savings Programs – expect Ways and Means Committee members Richard Neal (D-MA) and Kevin Brady (R-TX) to reintroduce a bipartisan bill initially introduced in the prior Congress, H.R. 8696.

- Incentives for Supply Chain Improvement – other potential “carrots” aside from the “Made in America” credit.

- Mark-to-Market System for Taxing Capital Income – expect incoming Senate Finance Committee Chair Ron Wyden (D-OR) to push for his proposed mark-to-market system to become law.

- Payfors in Infrastructure Legislation – any sort of broad infrastructure bill will likely include some revenue raising tax provisions.

- Enhancement of Research and Development – this may include a reversal of the amortization requirements effective in 2022 via the TCJA, or an expansion of the payroll tax offset via the R&D credit for start-ups.

Hurdles to Enactment of Tax Legislation

While major tax changes are definitely in play for the 117th Congress, plenty of hurdles could impede or prevent significant tax policy changes. Some examples of these hurdles include:

Narrow Democratic Majority – A three-fifths super-majority (generally 60 votes) is needed to avoid the filibuster of legislation in the Senate. Therefore, Democrats will need to get some buy-in from Republicans, vote to eliminate the filibuster, or resort to the budget reconciliation process to pass legislation by a simple majority.

- Voting to eliminate a filibuster seems like a long-shot given Senator Joe Manchin’s (D-WV) opposition to eliminating the filibuster and that Democrats would need all 50 Democratic Senators to vote for elimination and have Vice President Kamala Harris break the tie.

- Budget reconciliation, which was used to pass the TCJA under Trump, involves a tedious process requiring both chambers to agree on a budget resolution, instructions on tax and mandatory spending, and staying within limitations concerning deficit increases. For a primer on budget reconciliation read this.

- Democratic Senators who may not always follow party lines:

- Senator Joe Manchin (D-WV) – moderate Democrat with a large Republican base.

- Angus King (I-MA) – Independent who generally aligns and caucuses with Democrats.

- Bernie Sander (I-VT) – Independent who generally aligns and caucuses with Democrats.

- KyrstenSinema (D-AZ) – moderate Democrat with a large Republican base.

- Essentially, in order to get a bill passed in the Senate every Democratic Senator would have to support the legislation, or a couple of Republicans would need to support the bill. Absent bipartisan support, this gives each and every Democratic Senator significant power concerning the content of bills and the passage thereof.

Other Competing Democratic Priorities – there is a laundry list of policies that various Democrats will be pushing for legislative action. The priority of any of these policies may change given current events, the economy, and COVID-19. Again, COVID-19 relief currently has top priority, but other policy goals covering election reform, healthcare reform, climate change and green energy, infrastructure improvements, and employee benefits may jump ahead of tax reform and delay sweeping tax legislation.

The State of the Economy – if unemployment continues to creep back up and the economy still struggles after the American Rescue Plan, then many Democrats may be reluctant raise corporate tax rates that may increase job losses and business failures, particularly the Democratic Senators up for election in the 2022 mid-term elections.

Alternatives to Tax Legislation

Assuming Janet Yellen is confirmed as the next Secretary of the Treasury, hiccups or delays in the legislative process could lead to Democrats trying to shift tax policy via regulatory revisions and adjustments. As the new Secretary, Yellen is likely to revisit, evaluate, and address the Regulations issued by the Trump administration. Some particular Regulations she might consider revising include:

- The High-Tax Exclusion under the GILTI regime – there is already pending legislation to prevent Treasury from making this kind of carve-out administratively. Yellen could have Treasury reverse its position here.

- Opportunity Zones – Yellen may tighten the requirements for the substantial improvement of properties and increase the transparency of the metrics to measure improvement.

- Section 199A 20% Deduction – Yellen may change some of the definitions or certain businesses, like financial service firms, and tighten some of the guidance regarding real estate.

- Bypass of the SALT Cap – Yellen will likely be pressured by other Democrats to weaken the SALT Cap by revising prior guidance related to bypass mechanisms and workarounds.

- Enforcement – Yellen will be able to shape and influence the enforcement efforts of the IRS, and the IRS is likely to receive more funding to increase enforcement efforts and raise revenue.

Conclusion

Given the current political environment, a swath of bipartisan legislation, aside from COVID-19 relief, seems unlikely. However, if the economy improves, the odds of the Democrats pursuing a sweeping tax bill through the budget reconciliation process remain high in the second half of the calendar year or in 2022. Individuals making over $400,000 should anticipate max tax rates increasing to 39.6% and hope that the increase is not made retroactive to the beginning of 2021. Corporations should expect some sort of rate increase, though it may not increase to 28%. Finally, even in this environment certain tax policies may achieve some bipartisan support and lead to legislation, like green energy incentives, retirement savings enhancements, supply chain incentives, and payfors related to infrastructure improvements.

President-Elect Biden's Tax Proposals Table

Click here or on the graphic to view a pdf of the full table.

About Maynard Nexsen

Maynard Nexsen is a full-service law firm with more than 550 attorneys in 24 offices from coast to coast across the United States. Maynard Nexsen formed in 2023 when two successful, client-centered firms combined to form a powerful national team. Maynard Nexsen’s list of clients spans a wide range of industry sectors and includes both public and private companies.