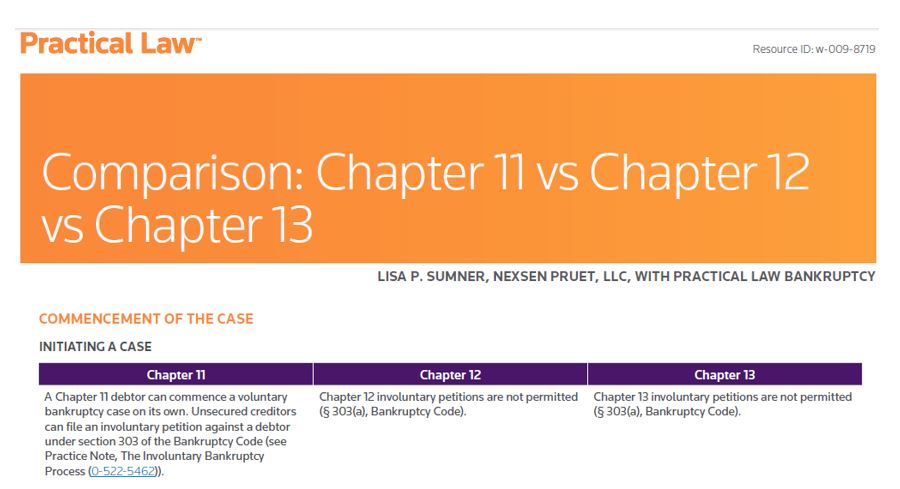

Comparison: Chapter 11 vs Chapter 12 vs Chapter 13

A chart providing an overview and comparison of the major facets of an individual Chapter 11 reorganization case, a Chapter 12 adjustment of debts of a family farmer or fisherman with regular annual income, and a Chapter 13 adjustment of debts of an individual with regular income.

A chart providing an overview and comparison of the major facets of an individual Chapter 11 reorganization case, a Chapter 12 adjustment of debts of a family farmer or fisherman with regular annual income, and a Chapter 13 adjustment of debts of an individual with regular income. The chart examines several crucial issues, including commencement of the case, case administration, and plans of reorganization.

The Chapter 12 process provides family farmers and fishermen with an opportunity to reorganize in a manner that is tailored to fit their circumstances better than Chapters 11 or 13. Chapter 11 reorganizations are ideally suited for large companies with strong existing management or for sole proprietorships. Individual Chapter 11 reorganizations may be an individual debtor’s only option due to factors restricting an individual debtor’s eligibility under Chapter 7 or Chapter 13. However, the duties of a Chapter 11 debtor and the associated time and expense are prohibitive to many farmers and fishermen. Chapter 13 is designed for individuals but is not well-suited for individuals or entities whose income fluctuates seasonally and who have large business-related debts. Chapter 12 incorporates many of the same provisions of the Bankruptcy Code as do Chapter 11 and Chapter 13 but with significant operative differences.

This chart compares several aspects of a bankruptcy case under these three chapters of the Bankruptcy Code, including:

- Initiating Chapter 11, 12 and 13 cases and requirements to be eligible as a debtor under each (see Commencement of the Case).

- General case administration (see Case Administration).

- The role of the US Trustee (see Role of US Trustee/Bankruptcy Administrator).

- Plans of reorganization (see Plan of Repayment or Reorganization).

Click here or on image below to see full chart:

About Maynard Nexsen

Maynard Nexsen is a full-service law firm with more than 550 attorneys in 24 offices from coast to coast across the United States. Maynard Nexsen formed in 2023 when two successful, client-centered firms combined to form a powerful national team. Maynard Nexsen’s list of clients spans a wide range of industry sectors and includes both public and private companies.

Related Capabilities